Wave Technology Group is a company my partners and I recently engaged through the University of Chicago Hospital's Pediatric Epilepsy Center. Wave was launched by Sam Cinquegrani, a local Chicago entrepreneur who cut his teeth is software developing object-oriented platforms for institutional clients such as the City of Chicago and the Chicago Board of Options Exchange (CBOE) and Fortune 100 corporations, namely JP Morgan and Mitsubishi.

The World We'll Inherit

As a student of politics and a passionate believer in globalization, I have become increasingly frustrated by the sense that we, the next generation of world leaders, have been completely marginalized by selfish and unimaginative lawmakers in capitols around the world. It is my hope that this blog can serve as a forum for young, ambitious and articulate men and women who get it. What kind of world do you want to inherit?

3/24/2010

The American National Broadband Plan on Health Care: Opportunity in Abundant Supply

Wave Technology Group is a company my partners and I recently engaged through the University of Chicago Hospital's Pediatric Epilepsy Center. Wave was launched by Sam Cinquegrani, a local Chicago entrepreneur who cut his teeth is software developing object-oriented platforms for institutional clients such as the City of Chicago and the Chicago Board of Options Exchange (CBOE) and Fortune 100 corporations, namely JP Morgan and Mitsubishi.

2/08/2010

Federal Telemedicine News: $125 Billion Budget Request

Monday, February 8, 2010

$125 Billion Budget Request

Eric K. Shinseki, Secretary of the Department of Veterans Affairs appeared before the House Committee on Veterans Affairs on February 4th to discuss the President’s VA budget request for FY 2011. The President’s budget provides $125 billion in 2011 which is almost $60.3 billion in discretionary resources and nearly $64.7 billion in mandatory funding.The Secretary reported that in December 2009, the VA successfully exchanged electronic health record information in a pilot program between the VA Medical Center in San Diego and a local Kaiser Permanente hospital using the Nationwide Health Information Network. During the second quarter of 2010, DOD plans to join the pilot and there are plans to add additional Virtual Lifetime Electronic Record health community sites. The VA has $52 million available in IT funds in 2011 to continue the development and implementation of this priority.

The budget provides $51.5 million to use for medical care in 2011, which is an increase of $4 billion or 8.5 percent over the 2010 level. In 2011, the budget provides $2.6 billion to help meet the needs of veterans who have served in Iraq and Afghanistan.

The FY 2011 budget also includes funding to treat new patients resulting from the recent decision to add Parkinson’s disease, ischemic heart disease, and B-cell leukemia to the list of presumptive conditions for veterans with service in Vietnam.

The VA’s 2011 budget includes $250 million to strengthen access to healthcare for 3.2 million enrolled veterans living in rural and highly rural areas. Plans are to provide new rural health outreach and delivery initiatives and to expand the use of home-based primary care and mental health services.

The VA intends to expand the use of cutting edge telehealth technologies and would like to invest in $163 million in 2011 for home telehealth to take advantage of the latest technological advancement in healthcare delivery. The VA’s home telehealth program cares for 35,000 patients and a recent study found that patients enrolled in home telehealth programs experienced a 25 percent reduction in the average number of days hospitalized and a 19 percent reduction in hospitalizations.

According to the Secretary, the Department’s IT operations and maintenance program supports 334,000 users situated in 1,400 healthcare facilities, 57 regional offices, 158 national cemeteries around the country, plus the IT program maintains 8.5 million vital health and benefit records for veterans. The FY 2011 budget provides $3.3 billion for IT, which is the same level of funding provided in 2010.

The IT resources requested would fund IT to process education claims, to help the Financial and Logistics Integrated Technology Enterprise project replace outdated technology, further develop the paperless claims processing system, and continue to develop the VA’s EHR system for $342.2 million.

Posted by Carolyn Bloch at 7:24 AM

1/28/2010

New Physician Adoption Statistics « Health IT Buzz

New Physician Adoption StatisticsTuesday, January 26th, 2010 | Posted by: Dr. David Blumenthal | Category: ONCThe CDC recently released its latest report on the adoption of electronic health records/electronic medical records (EHR/EMR) amongst office-based physicians from the National Ambulatory Medical Care Survey. As a physician who trained and initially practiced in a time where nearly every order, record, and prescription was paper-based, the results are striking to me.

The final results for 2008 show about 16.7 percent of physicians reported having systems that met the criteria of a basic EHR/EMR system, and about 4.4 percent reported that of a fully functional system. Preliminary results for 2009 show about 20.5 percent reported having systems that met the criteria of a basic system, and 6.3 percent reported that of a fully functional system.

Combined basic and fully functional statistics for the last 3 years are as follows:

- 2007 – 17%,

- 2008 – 21%,

- Preliminary 2009 – 27%

The latest figures, especially the preliminary 2009 numbers, suggest that the pace of adoption of HIT is quickening. We expect that the federal government’s health IT strategy will accelerate the pace even further by systematically addressing the obstacles physicians experience in adopting health IT (see below).

HOW THE US FEDERAL GOVERNMENT IS SUPPORTING HEALTH INFORMATION TECHNOLOGY USE

The Obama administration believes health information technology (HIT) is a critical component of efforts to improve the quality, efficiency, and value of care delivered to patients. The Office of the National Coordinator for Health Information Technology (ONC) is leading the administration’s efforts to support the thoughtful application of HIT. Cognizant of the numerous barriers that exist to making health IT work in real-world settings, the ONC is administering programs to systematically address these barriers:

OBSTACLE INTERVENTION FUNDS Financial Resources Medicare and Medicaid Incentive Program: incentive payments to “meaningful users” who use health information technology to improve value and efficiency of care delivered to patients Technical Assistance Regional Extension Centers: Up to 70 regional extension centers (REC) will help providers through the process of selecting and implementing electronic health records $643 Million The vision of a health care system that uses information technology to improve the value of services to patients is inching closer towards reality.

The ONC is committed to making the transition to electronic health records successful for every physician and hospital.

I hope you will share the experiences, challenges, and success stories that belie these encouraging statistics.

– David Blumenthal, M.D., M.P.P. – National Coordinator for Health Information Technology

National Coordinator for Health Information Technology, David Blumenthal, MD, blogs about physician adoption of electronic health records, a subject on which he has long been the go-to authority. With merely 27% of physicians deploying a fully functional EHR, its now up to Blumenthal to find real solutions and strategies for stimulating widespread adoption. So far his ideas and initiatives have been promising.

1/27/2010

Video Conferencing saving lives in Irish Hospitals

Claire O’Connell in the Irish Times has an interesting article on how a stroke patient at the Midland Regional Hospital in Mullingar received urgent and potentially life-saving treatment on Sunday after a consultant at another hospital used the RP-7 (the “Remote Presence Robot” pictured below) to assess her remotely and prescribe clot-busting medication.

“The patient, who had a stroke just after noon, was collected by ambulance and was at the Midland Regional Hospital in Mullingar by 1.30pm. She was assessed by Prof Des O’Neill at Tallaght Hospital using the RP-7, which also allowed him to talk with her, examine her scans and discuss treatment with members of the medical team in Mullingar. The patient was on clot-busting medication by 2.40pm and her condition improved in half an hour”

Prof O’Neill commented on this first with a reminder of the short time window there is for putting suitable patients on potentially life-saving thrombolytic drugs; “The key challenge is to get people to have their clot-busting drug within three hours of a stroke.”

This entry was posted on Wednesday, January 20th, 2010 at 10:42 am and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Personal Health Systems: A View from Across the Pond | Chillmark Research

The European Union (EU) is struggling with many of the same healthcare issues as the US, aging population, ever increasing costs of care and the need to move to new modalities of care. This is one of the key take-aways from a recent EU-sponsored report: Reconstructing the Whole: Present and Future of Personal Health Systems. This report looks at the present state of Personal Health Systems (PHS), assesses gaps (technology, process & culture) and lays out what is required to meet the “promise of PHS” by the year 2020.

The report takes a very broad brush to what is PHS including IT, sensors, diagnostics, and drug development (personalized). This is a big report at some 240pgs and unfortunately is one of those reports that is all too big and all too academic to be useful to the average healthcare wonk. But tucked within this future, sitting-on-the-bookshelf and collecting dust report are a couple of tidbits worth mentioning.

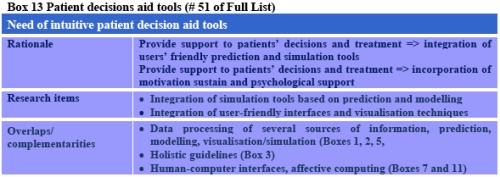

On pages 79-86 are a series of gap analysis tables (20 in all) addressing a wide range of areas associated with PHS. Below is the Table addressing Patient Decision Aid Tools.

While the above gap analysis tables are instructive, they are not terribly “deep” and at times come across as superficial – thus would make good fodder for a “high-level” presentation to a less informed audience.

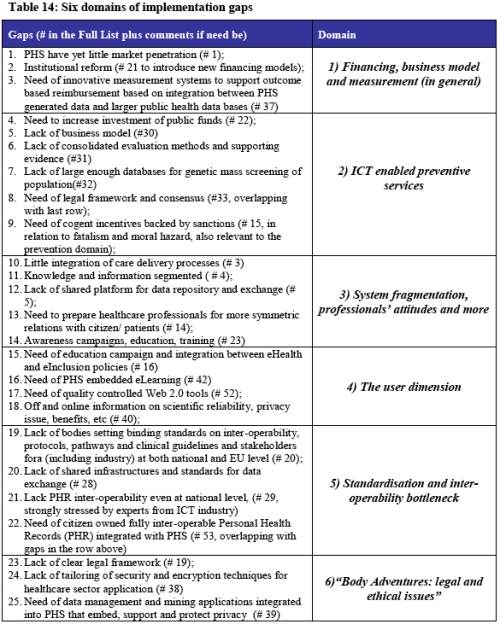

Arguably the best Table is found towards the end of the report titled: Six Domains of Implementation Gaps.

The table clearly lays out what are the future challenges to broader adoption and use of PHS. The key take-away here is the surprising similarity between the US and its EU counterparts in the deployment and use of PHS, despite what are very different healthcare system models. Which raises the question: Will such uber-players in the Personal Health Platforms (PHP) market, e.g., Dossia, Google Health and HealthVault create the systems and platforms required to support PHS data requirements? HealthVault’s move into international markets, (Canada and Thailand) signal yes, but will providers, payers and ultimately consumers join in?

Still more questions then answers at this early juncture in the development of consumer-focused systems and platforms. But there is a ray of hope in the global commonality of challenges faced that will lead to increasing attention and subsequently resources dedicated to bridging the gaps, addressing these challenges to create more effective and efficient care delivery models.

Possibly related posts: (automatically generated)

Chillmark Research does some very nice digging for useful learnings to be gleaned from an EU-sponsored report on the present and future of personal health systems. The second chart in particular does a great job of outlining the barriers to the establishment of a wholly unified personal health system.

Federal Telemedicine News: MHS IM/IT Plan Approved

MHS IM/IT Plan Approved

The Military Health System Information Management/Information Technology Strategic Plan for 2010-2015 has been approved by the Senior Military Medical Advisory Committee. Leaders from the Army, Navy, Air Force, Health Affairs, TRICARE Management Activity, Joint Staff, Joint Task Force National Capital Region Medical, and the MHS Office of the Chief Information gathered last summer for a series of workshops to develop the plan.While there have been strategic planning initiatives that have guided key priorities throughout the last ten years, this new effort by IM/IT leadership across the services, is the first formally approved plan since 1999.

The plan’s ten IM/IT goals that the Military Health Service (MHS) will focus on over the next five years are to:

• Provide rapid, affordable, secure delivery, and life cycle support for IT products and services

• Provide a comprehensive longitudinal EHR for all beneficiaries and care settings

• Implement a governance structure and process to enable effective and efficient use of resources

• Enhance enterprise intelligence through the use of enterprise tools, data, and services

• Advance the MHS personalized health agenda so that patients would have electronic access to their own records, have virtual visits, and be able to refill prescriptions online

• Advance IT interoperability using health, operational, and functional partners to create an accessible and complete virtual lifetime electronic record

• Show how the flow of funds from programming to execution can improve using better cost estimating methodologies

• Establish an innovation lifecycle management process to align IT innovation with MHS strategy

• Improve human capital management by having the right people with the right training and experience on the right job

• Develop processes, guidance, and standards to develop and integrate distributed services and applications so that time and money spent on products can be delivered rapidly and with a minimum amount of modificationIn total, the planning team drafted 13 unique action plans and 14 performance measurements to define specific activities, deliverables, and milestones. In the months ahead, the IM/IIT strategic planning team will work with the action plan teams across the MHS and then draft updates, review the IM/IT measures, and determine if and how these measures should link to the broader MHS Value Measures dashboard.

For more information, go to www.health.mil/mhscio/governance.htm.

This would be a great action plan for innovating/improving any health system, from the military to local and regional providers. Hopefully this crosses the president's desk and he adopts some of the major action items to his own health reform agenda. These are the major things that need to be addressed which will have the greatest impact on the health care industry.

1/23/2010

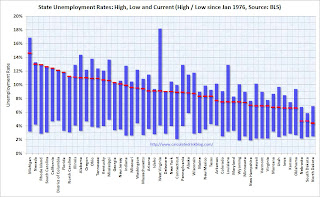

Unemployment Rate Increased in 43 States in December

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally higher in December. Forty-three states and the District of Columbia recorded over-the-month unemployment rate increases, four states registered rate decreases, and three states had no rate change, the U.S. Bureau of Labor Statistics reported today. Over the year, jobless rates increased in all 50 states and the District of Columbia.

...

Michigan again recorded the highest unemployment rate among the states, 14.6 percent in December. The states with the next highest rates were Nevada, 13.0 percent; Rhode Island, 12.9 percent; and South Carolina, 12.6 percent. North Dakota continued to register the lowest jobless rate, 4.4 percent in December, followed by Nebraska and South Dakota, 4.7 percent each. The rate in South Carolina set a new series high, as did the rates in three other states: Delaware (9.0 percent), Florida (11.8 percent), and North Carolina (11.2 percent). The rate in the District of Columbia also set a new series high (12.1 percent).

emphasis addedClick on graph for larger image in new window.

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

Sixteen states and D.C. now have double digit unemployment rates. Indiana, Missouri and Washington are all close.

Five states are at record unemployment rates: South Carolina, Florida, North Carolina, Georgia and Delaware, and several other states are close.

Privacy & Security of Personal Health Information | Chillmark Research

On Saturday, Jan. 10th, I’ll be moderating a panel at the Consumer Electronics Show’s (CES) Digital Health Summit. The distinguished panel that includes executives from Dossia, Kaiser-Permenante, Microsoft and Walgreens will address the topic: Who Will you Trust with Your Health Data?

In preparation, I have been doing some research on the subject and following are a few data points for consideration:

Since April 2003, HHS’s Enforcement Office has handled over 9,666 cases that required some form of enforcement/corrective action regarding HIPAA privacy and security violations of Personal Health Information (PHI). That works out to over 1,200 cases a year.

In 2009, PrivacyRights.org reports that there were 46 breaches of PHI representing nearly 80M records. Note that 76M of those records were from the VA that inadvertently sent one of its RAID drives out for repair without cleansing it of those 76M records of veterans. If you can’t trust the government to keep your PHI safe, who can you trust?

Subtract the VA outlier and you get about 4M individuals who had their PHI breached in 2009 across 45 documented incidents or about 89,000/breach. That’s a lot of compromised records!

Also in May of 2009 we saw the Virginia Health Data, Dept of Health Professionals get hacked in which 531,000 individuals PHI were compromised and held ransom by the hackers for a cool $10M.

And let us not forget CVS who was fined $2.25M for sloppy disposal of prescription records. No one has any idea as to how many individuals may have been compromised in this blunder by a major pharmacy chain.The scary thing about the above is that these numbers represent documented/reported cases of data breaches and it would be easy to argue that the actual number of breaches that occur in a given year is quite a bit higher (let’s remove the 76M records in the VA breach as that really is out there).

This all raises the question:

If organizations like the VA, the Virginia Health Data, Dept. of Health Professionals and some of the most prestigious hospitals in the country can’t keep PHI safe, who can?

Which logically leads to the next question…

Is there any true, fool-proof way to insure absolute privacy and security of PHI that is held by a covered entity, business associate or even an organization like Microsoft or Dossia acting on behalf of the consumer?

Yes, there are strong passwords, yes, data can be encrypted on a server but for just about every barrier thrown up, hackers have found a way to break in. Also, beyond just hackers, what is surprising is that a number of the PHI breaches in 2009 were done by employees who were then selling such data to others, such as ambulance chasing lawyers and tabloid magazines.

Which leads me to conclude…

Maybe the belief in absolute privacy and security of PHI is a fallacy.

As we move to digitize PHI through the adoption and use of EHRs by physicians and hospitals it is inevitable that we will see more breaches. Hopefully, the benefits that we, as a nation and citizens, accrue from the adoption and use of such digital records to better manage our health and coordinate health among our healthcare team will far outweigh the risks we will be taking in the potential compromise of our PHI.

Possibly related posts: (automatically generated)

1/01/2010

Billionaire Doctor Puts His Money Where His Mind Is... - Connected Care Solutions

Patrick Soon-Shiong elaborates in this CNBC feature on his ambitious vision and $1Billion philanthropic commitment to build a true naitonal Public HealthGrid.

Boldly, and brilliantly IMHO, Soon-Shiong asserts that we need to stop obsessing over advances in genomic, biotech and nanotech R&D and recognize that health systems, technology parks and even most academic research labs are ill-equipt to discover anything "meaningful" from this deluge of random data. It will be "mathematicians, physicists and computer scientists" that Dr Soon-Shiong believes hold the key to unlocking the greatest potential value for patients, physicians, regional providers, public health agencies and society at large.

The politician inside me hears Dr Soon-Shiong's vision to be a blueprint for sowing the seeds of a hyper-modern renaissance movement in America. By using "team science" to engage the greatest minds from every scientific discipline in one unified pursuit of a wickedly complex problem, Patrick may have unwittingly stumbled onto the secret formula for reshaping the very fabric of society!!

Public Health Informatics Institute | phConnect.org

phConnect is a web-based, interactive, collaboration platform created for public health professionals and those interested in public health to meet, share expertise, and work together on advancing public health. phConnect has been created to foster collaboration and communication across PHIN CoPs, the larger public health community, the health informatics community, and with other partners.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=dc338d29-8986-48fd-b9b8-34981b91ce5f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=0d8ff51d-41da-4bf1-8862-cca461979358)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=c96d68c2-cadf-419f-86d7-a13974f663f8)